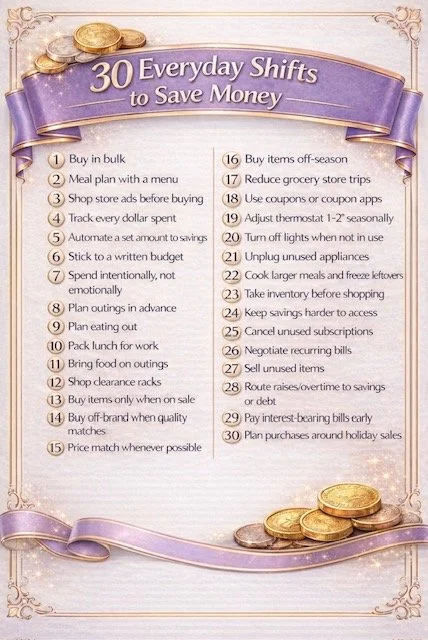

30 Everyday Shifts That Save Money

Written by Ronie Deus | Financially Centsible™

Most people don’t need another budget.

They need breathing room.

If money has felt loud, stressful, or constantly demanding your attention, it’s probably not because you’re careless or irresponsible. It’s usually because no one ever showed you how small, intentional systems can change the way money behaves in your life.

The truth is:

Many money problems aren’t income-only problems — they’re structure problems.

That doesn’t mean income doesn’t matter. In many places, it absolutely does.

But even when income stays the same, the way money is handled can dramatically change how tight or calm things feel.

And systems don’t have to be complicated, restrictive, or joy-killing.

This Isn’t About Doing More. It’s About Doing Differently

The list you just saw isn’t about extreme frugality or cutting everything you enjoy.

It’s about everyday shifts — the kinds that fit into real life.

Especially if you’re busy.

Especially if you’re responsible.

Especially if you’re tired of being told you’re doing it “wrong.”

You don’t need to overhaul your entire life to make progress.

You need fewer leaks — and better structure.

That’s where momentum starts.

Why Everyday Shifts Work Better Than Big Overhauls

When money feels tight, people assume the solution has to be drastic.

Cut everything.

Cancel all fun.

Live on willpower.

But willpower fades.

Systems stick.

Sometimes it’s one decision.

Buying too much house.

Financing a car that stretches the month too thin.

Refinancing without seeing the long-term cost.

But more often, financial stress builds from small, unmanaged choices happening quietly in the background.

Subscriptions that pile up.

Convenience spending that becomes routine.

Vacations charged instead of planned for.

Monthly “extras” that don’t feel big — until they add up.

When you seal a few leaks and put simple systems in place, something powerful happens:

Decisions get easier

Stress goes down

Progress feels possible again

That’s not discipline.

That’s stability by design.

A Few Sleeper Wins You Might Be Underestimating

You don’t need to implement all 30 shifts at once. That’s not the point.

But a few of them quietly do a lot of heavy lifting.

1. Keeping savings harder to access

This isn’t about self-control — it’s about reducing temptation.

When savings isn’t sitting next to spending money, you stop negotiating with yourself every week.

Less friction = more consistency.

2. Taking inventory before shopping

Most overspending does not come from a state of recklessness — it comes from a lack of examination.

Buying duplicates, replacing things you already own, or shopping without a clear picture creates invisible waste.

Awareness alone saves money.

3. Planning purchases around holiday sales

This is patience working for you.

When purchases are planned instead of reactive, you stop paying full price for convenience.

Time becomes your ally.

4. Cooking larger meals and freezing leftovers

This isn’t about “never eating out.”

It’s about creating backup options so tired decisions don’t become expensive ones.

Structure beats motivation every time.

5. Routing raises or overtime intentionally

Extra money disappears fast without direction.

When you decide in advance where it goes, progress accelerates without feeling painful.

That’s how momentum compounds.

Here’s the Reframe Most People Need

Saving money isn’t about being “good” with money.

It’s about designing your life so money stops yelling at you.

These everyday shifts aren’t random tips.

They’re the kinds of things people usually figure out after money has stressed them out long enough.

When you start putting even a little structure around your money, things feel different.

Shifting Your Mindset

Shifting your mindset is at the core of The Centsible Shift™ — learning how money really works, putting systems around your decisions, and keeping emotion from running the show.

Not doing more.

Not tightening everything.

Just setting money up so it behaves better in real life.

If this post felt grounding, that’s not an accident.

These shifts are small on purpose — because small changes are the ones that actually stick.

You don’t have to fix everything at once.

You just have to start where the leaks are.